UK Tech M&A Outlook: Sentiment Improving

finnCap Group assesses the prospects for an uptick in UK technology M&A – and where pockets of activity can be expected.

Whilst recent months have seen a drop in deals due to uncertainty on both the political and macroeconomic fronts, we have started to see sentiment improve and the volume of conversations pick up, certainly among founder-backed businesses within the UK, where there are concerns on the outlook for capital gains taxes, post an expected general election in Q4 2024. History has taught us that there is only so much capacity to look at new transactions in the market, notably in the period from September 2020 to March 2021, when a lot of transactions failed to get away ahead of a feared CGT rise in the March 2021 budget.

On the positive front, a continued rotation away from sectors exposed to consumer discretionary spend and towards more resilient sectors, such as technology, means that the level of dry powder looking to be deployed is at record levels and, in many cases, deployment is behind schedule. This means that transactions displaying the right characteristics, such as those below, are still able to command premium multiples:

- Strong levels of organic growth

- Demonstrable profitability and cash generation

- A differentiated market position and, in many cases, a strong focus on specific verticals

- High degrees of recurring revenue and sticky customer relationships

- Successful land-and-expand strategies within clients

Differences between sub-sectors within technology

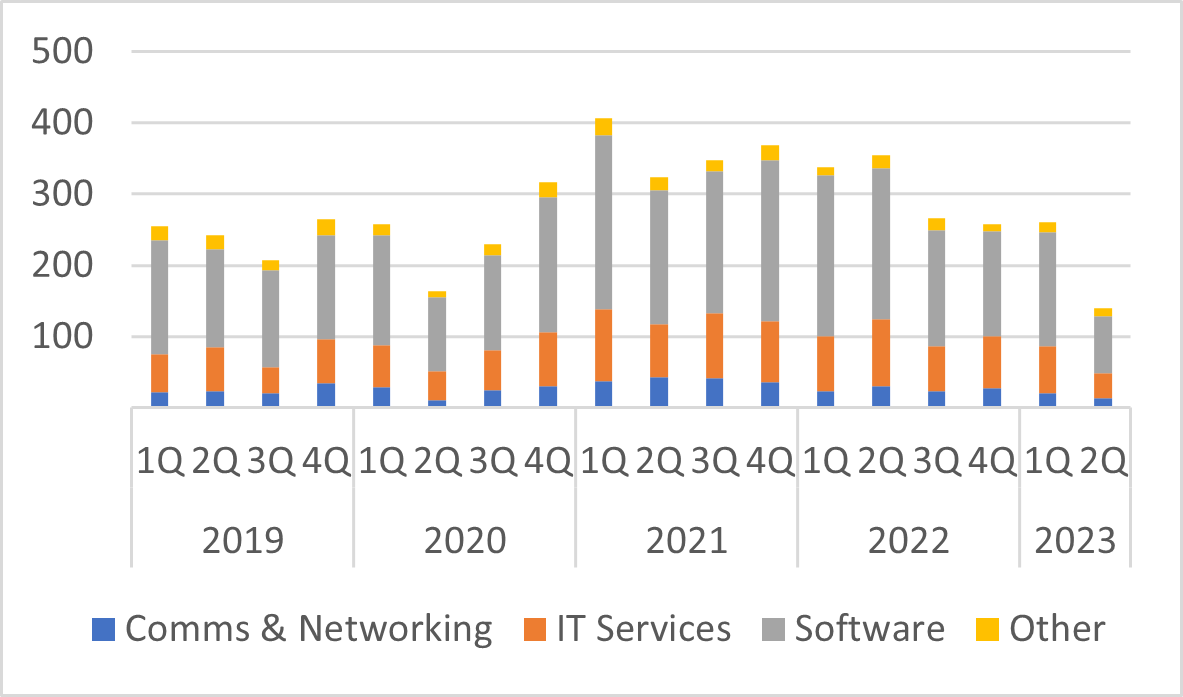

Looking at M&A volumes within the UK, the record transaction volume was in Q1 2021, coincidentally the last time there were significant rumours around a potential increase in the UK capital gains tax in that year’s March budget.

Source: PitchBook Data, Inc.

Many different dynamics are at play when looking at M&A within the broader technology sector and a quick look at three of the main sub-sectors can be used to illustrate diverging performance and consequently significantly different drivers of M&A.

Managed Services

Managed services as a sub-sector continues to demonstrate its resilience, with growth rates in the mid-teens. Businesses are increasingly looking for a trusted outsourced IT partner who can deliver a convergent range of solutions to meet ever-increasing digitisation and a fast-changing market environment. The shift of focus at the C-Suite — from viewing core IT networks as a cost to seeing them as an integral element underpinning the delivery of technology and as a tool to enhance the customer and user experience — will support growth dynamics. Those providers that can demonstrate areas of differentiation, be it horizontal (e.g. specific platform capabilities), or vertical (e.g. specific sector knowledge and delivery capability), will continue to be in strong demand and are likely to benefit from a virtuous growth circle. As such, valuation multiples have remained resilient in the past 24 months, with those assets perceived to tick all the boxes commanding ever-higher multiples. The one exception to that is managed service providers looking to build scale for scale’s sake. With the cost of capital rising, the ability to demonstrate strong levels of organic growth has become a necessity for providers looking to adopt a buy-and-build strategy.

Software

Within software, we have seen a significant flight to quality, with investors focusing on the level of annual recurring revenue (ARR) alongside gross and net revenue retention metrics and, perhaps most importantly, looking for profitability rather than cash-burn focused on growth at any cost. Both horizontal (e.g. software targeted at a specific business area such as HR) and vertical (e.g. software targeted on a particular end market) focused software valuations have remained relatively robust as investors recalibrate towards opportunities that have the potential to disrupt their end markets but do not require multiple cash calls in order to do so. Consequently, we have seen the number of deals within the UK software sector falling below the five-year average in each of the last three quarters.

Digital Transformation Consultancies

Given the nature of the business model, with its need to build up capacity and bench depth ahead of contract wins, digital transformation consultancies have experienced harder trading conditions in 2023. For example, Kin + Carta and Endava have both downgraded forecasts multiple times, as macroeconomic uncertainty and hesitance from enterprise clients to commit to large programmes has hit pipeline delivery. However, there have also been pockets of strong growth, especially in areas such as Workday [NASDAQ: WDAY], ServiceNow [NYSE: NOW], MongoDB [NASDAQ: MDB] and other in-demand platforms where specialist implementation partners benefit from the tailwinds. This is also true for implementation partners focused on the hyperscalers, such as Microsoft Azure and Google Cloud. Characterised as the greatest organic growth market ever known, there has been significant M&A activity around the specialist partner universe, e.g., Perwyn’s investment in Datatonic and Marlin Equity Partners’ investment in CTS. This has also led to significant divergence of multiples across the sector, with those at the lower end going for 5x-7x EBITDA, whilst those that are viewed to have scarce and in-demand capabilities going for 3x revenue and above.

What do we expect for the next 12-24 months?

Certainly, based on all the conversations we are having in the market, we remain optimistic about the outlook for the next 18 months. Founders are being forced to recognise the binary nature of the uncertainty around CGT increases and the need to undertake thorough preparation before launching a process, not only to maximise the probability of achieving a premium valuation but, perhaps more fundamentally, achieving a successful transaction in what we expect to be a very crowded market. Given the likely significant impact on a founder’s net proceeds from any change in CGT, there is no opportunity to test the market and then come back a second time under the election timelines expected above. Preparation is therefore key to ensuring that a business is presented in the best light.

Within the different sub-sectors, managed services has seen a lot of activity historically and we expect this to continue, as providers look to become one-stop shops for the customer to ensure they retain not just a share of customer wallet but also a significant share of customer mind. Project services have historically been viewed as inferior to recurring revenue from a value perspective, but as cloud implementation drives the end customer to revisit the entirety of their IT, the ability of the provider to capture customer mind share and ensure they do not get disaggregated by other partners coming in has become a significant focus during the due diligence phase of a potential acquisition.

Within software we do not expect a return to valuations seen in 2020/21 but believe that there will continue to be a flight to quality, supporting valuations at the top end. We believe that software transaction volumes will remain robust, driven by companies with a smaller cash burn being acquired, and by founders looking to take capital off the table ahead of potential tax changes.

Within digital transformation, one of the big themes we expect to see is continued consolidation. Within what remains a highly fragmented market, the big SI’s continue to look to acquire specialist capabilities to augment their existing business lines and provide additional cross-sell opportunities. Outside of that, consultancies that have seen pipeline challenges emerge are looking to turbocharge growth by adding a combination of additional scale, new capabilities and geographic expansion. As such, we currently expect digital transformation to be a relatively hot area by acquisition volume.

The role of debt

Outside of political risks, the most immediate threat — primarily to valuations but also to transaction volumes — is the cost and availability of debt. With base rates now at levels seen prior to the financial crisis of 2008, many funds are having to adapt to this new paradigm of the cost of debt routinely being in excess of 8%. This risk becomes even more stark when you consider that many of the more junior partners within these private equity funds have never operated in such an environment. Anecdotally, following on from a significant drop in the appetite of banks and debt funds in Q4 2022 and Q1 2023, we have not yet seen that confidence fully return. In fact, in recent months, greater caution on the levels of debt seems to be emerging.

In the UK, we continue to believe that there are enough positive supply-side and demand-side dynamics that will lead to a robust M&A market over the next 12-24 months, albeit one in which the cost of capital will rise up the list of critical areas to be addressed ahead of completing an acquisition.

About finnCap Group

finnCap Group is a diversified financial advisory firm offering a full range of services across M&A advice, equity and debt capital raising and related services to corporate and institutional clients and high net worth investors including private equity and family offices. It has particular strength in the technology, life sciences, consumer and business services sectors. finnCap Group has global reach through its affiliation with the Oaklins partnership and access to net zero and carbon economy consultancy through its partnership with Energise Limited.