Get actionable Intel before it goes public

The world’s leading source of M&A and financing intelligence in Telecoms, Media and Tech

Request Free TrialDesigned specifically for

- Investment Bankers

- Private Equity Investors

- M&A Advisory and DD

- Corporates and Operators

- Infrastructure Funds

- Law Firms

- Asset Managers

TMT industry coverage

- Digital Infrastructure, Fibre and Towers

- Enterprise Software, SaaS and ERP

- Datacentres and Cloud

- Telecoms and Connectivity

- IT, Managed Services and Security

- Ecommerce and Platforms

- Fintech

- Media and Content

no exact matches found

Relied upon by TMT professionals across the globe

Proprietary Intelligence

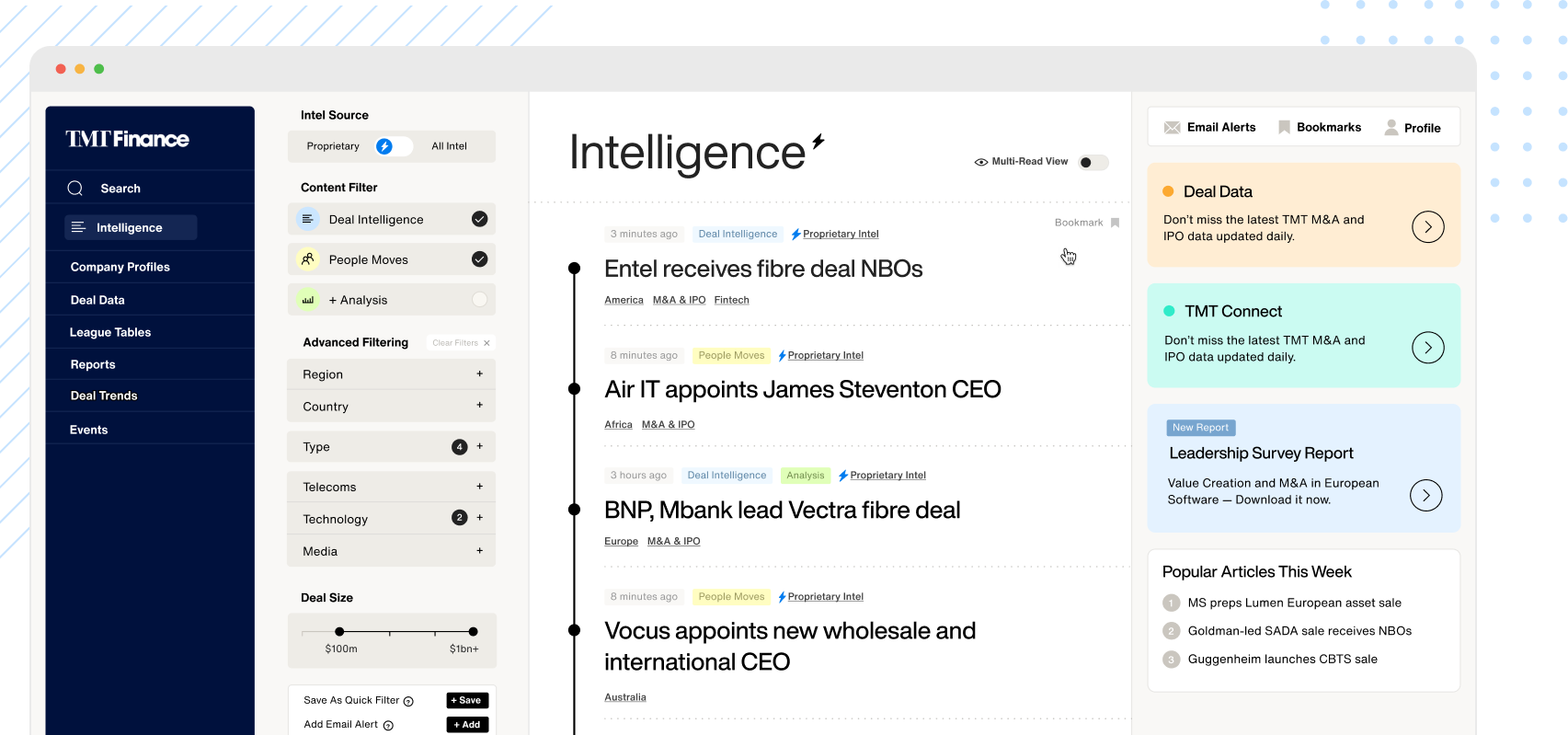

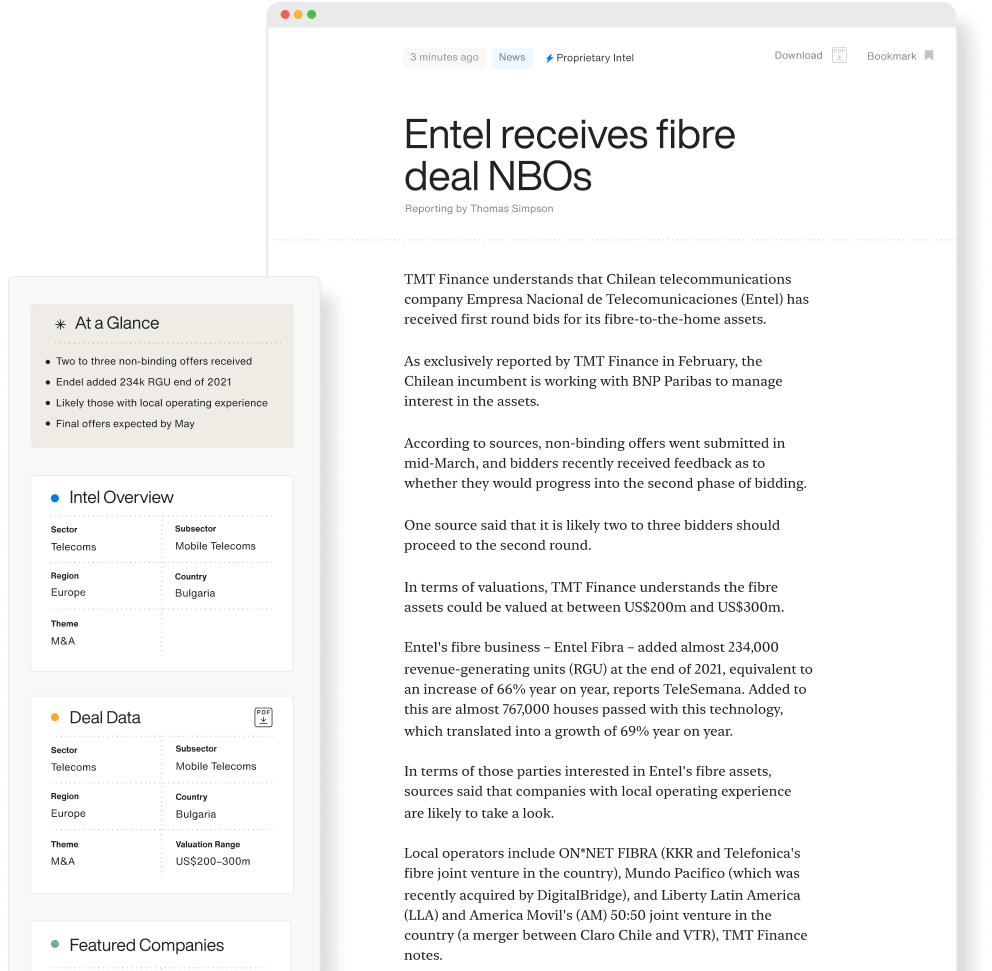

Get access to proprietary intelligence, data and analysis on TMT M&A and Financing months before it goes public, with 150+ new articles added every week.

Discover sample intelligence

Get the Competitive Advantage

- Win new mandates and investors.

- Learn first about deal developments.

- Identify new buyers, sellers and advisers.

- Benchmark valuations and competitors.

- Avoid being blindsided by new market moves.

Direct to

Your Inbox

Set custom email alerts based on sector, region, deal size or company which you can receive in real time, daily or as a weekly digest. Subscribers can also choose to receive up to 5 of our core product weekly emails covering: EMEA, Americas, Asia, People Moves and TechFinance.

Get started

Daily

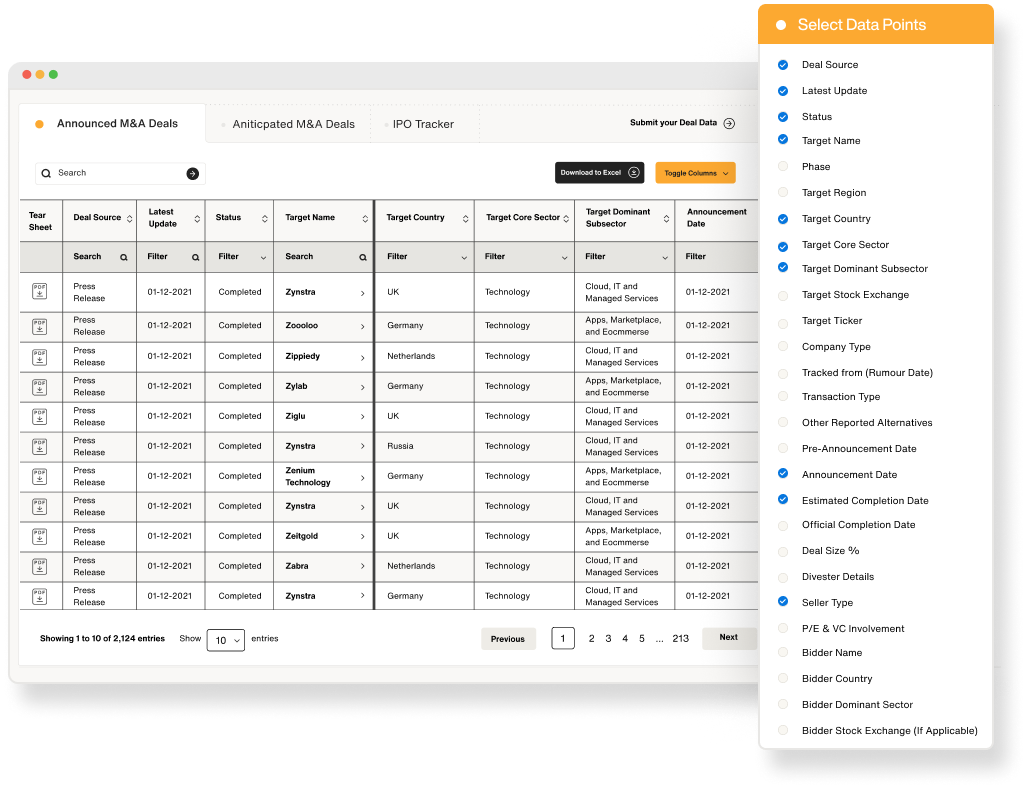

Deal Data

Search and download up to 9000+ live deals, using 70 customisable data points, including valuations and advisers, all updated daily by our in-house, CFA-accredited research team.

Find out more

Access to

40,000 Articles

Get access to over 40,000 articles on TMT M&A opportunities, stretching back to 2009. Use smart filtering and search functions to locate valuable info on historic mandates, bidder details, valuations and deal talk.

Request Free Trial

Learn

& Connect

Bringing together the key financial decision makers, investors and advisers in telecom, media and technology.

Find out more

A Feature Rich

Digital Experience

Robust Search

A powerful search engine and filter functionality to scour our article archive and read, bookmark or download your findings.

Bookmarking

Bookmark any article to return to it later or archive content of interest.

Multi-Read Mode

Select multiple articles right from the feed, and download or read in a continuous stream.

Custom Quick Filters

Quickly make and save shortcuts to return to your most used intelligence filters.

Get Started with

a Free Trial

Request Free Trial

- 150+ proprietary and curated articles each week on TMT M&A

- 8200+ deals in TMT DealData - updated daily

- Personalisable Real-Time Email Alerts and Filters

- Searchable Companies Database – 9000+ profiles

- 40,000+ articles to search online